Initial Interaction

Understand the goals.

Carry out risk profiling.

Provide all the information relating to the schemes for the investor to make an informed decision.

AMFI Registered Mutual Fund Distributor

"No two relationships are the same – ours should likewise be made to order. This belief is the cornerstone of our approach.

Behind every engagement with us is a dedication to collaboration and personal attention. That makes all the difference.

Today, that devotion remains unwavering, ensuring that your experience with us is not just good but exceptional.

As we move forward, we envision a future where our commitment to personalized service continues to evolve and exceed your expectations."

YEARS IN BUSINESS

30AUM IN ₹ CRORES

787AMC PARTNERS

41FAMILIES SERVED

779

At the core of our philosophy is an unwavering dedication to integrity, transparency, and trust. We believe in reshaping the landscape of mutual fund distribution in India by embodying the values of reliability and openness in all our interactions.

Our commitment extends beyond mere transactions; it is a promise to competency and fairness in all our dealings with investors.

To be India’s most transparent, reliable and trusted mutual fund distribution company.

To build lifelong relationships by consistently delivering exceptional client services that exceed expectations.

Navigating the intricate landscape of mutual funds requires specialized knowledge. We take pride in our role as a dedicated mutual fund distributor, bridging the gap between you and the dynamic world of investments. We will empower you with the knowledge and tools needed to make well-informed investment decisions.

We ensure that your transactions are executed efficiently, providing a hassle-free experience as you navigate the world of mutual fund investments. Investing is a journey, and we are here for the long haul! Our commitment extends beyond the initial transaction.

We offer continuous support, keeping you informed about market trends, fund performance, and any updates that may impact your investments.

Count on us to be your reliable partner on your financial journey!

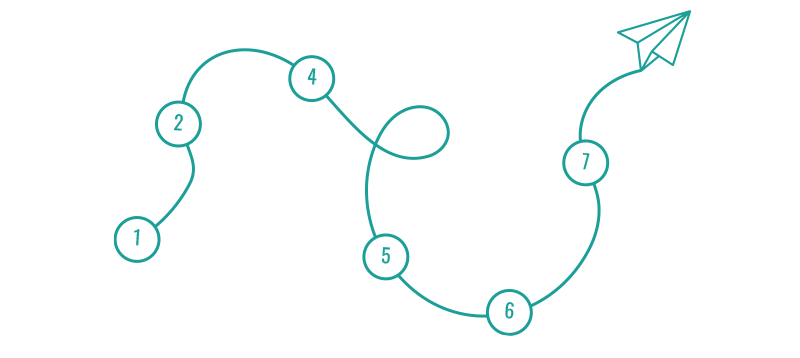

We take pride in delivering unmatched solutions through our refined workflow. Our comprehensive approach empowers you to explore the journey of mutual fund investments. Trust our carefully crafted process, blending expertise, innovation, and an unwavering commitment to your financial well-being.

Understand the goals.

Carry out risk profiling.

Provide all the information relating to the schemes for the investor to make an informed decision.

Collect FATCA and KYC documents.

Collect NSE registration documents.

Complete the KYC-related formalities.

Register the client with NSE.

Guiding investor's decisions and eliminating the complexities of investing in mutual funds.

Based on the information and our guidance, the investor decides on the schemes to invest in and the strategy. The investment process is completed online/offline.

Within three days of the execution of the investment, the investor is provided with online login credentials.

Guidance is provided to the investor to install our mobile App and the navigation is explained.

Regular connect is maintained to encourage portfolio monitoring under our guidance so that emotions are well-managed.

Periodical interactions to understand investor's concerns if any.

Take corrective steps if required.

Provide Capital gains and Holdings statement at the end of every FY for ITR filing.

Managing all the paperwork, tax obligations, and regulatory requirements to ease the investment process for you.

Managing all the paperwork, tax obligations, and regulatory requirements to ease the investment process for you.

Wondering about your retirement income needs, adequate life insurance coverage, the difference between the old and new tax regimes and which one suits you?

Our financial calculators are educational tools designed to provide estimates for common financial questions. They aren't meant to predict future outcomes.

Simply click on a general financial topic below to access user-friendly calculators that can assist you in making informed decisions.

These calculators are hypothetical examples used for illustration purposes and do not reflect the performance of any specific investment or product.

Rates of return may vary, especially for long-term investments. Remember that investments with the potential for higher returns also have a higher risk of loss.

Get going! Read more

We take pride in being associated with 41 Asset Management Companies (AMCs) in India, offering a diverse range of investment solutions. Explore the expertise and reliability that define our collaborations, providing you with a gateway to financial growth.